child tax credit november 2021 late

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming. If only one half of the couple owes.

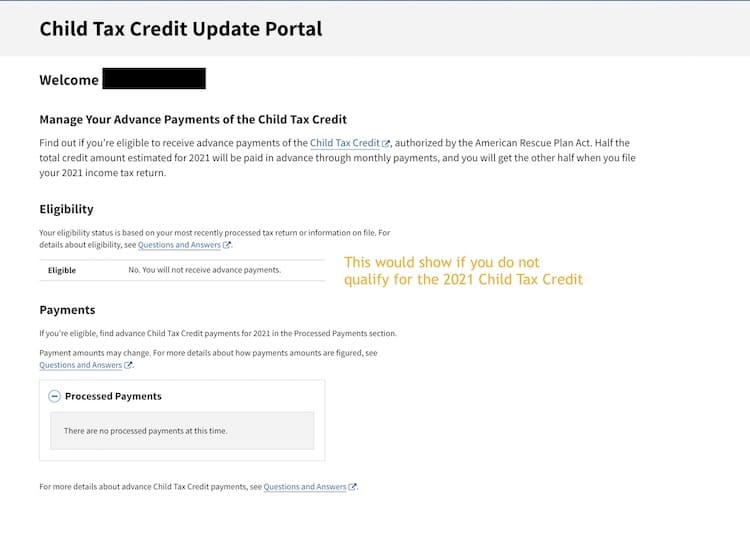

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. The enhanced child tax credit which was created as part of the 19. Youll just have to wait until 2022.

Most of the mill Es noticia. Youll need to print and mail the completed Form. At first glance the steps to request a payment trace can look daunting.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Per the IRS the typical overpayment was 3125 per child between the ages of 6 and 17 years old and 3750 per child under 6 years old.

Check mailed to a foreign address. The deadline for the next payment was November 1. So parents of a child under six receive 300 per month and parents of a child six or.

Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021. IR-2021-222 November 12 2021. The IRS will soon allow claimants to adjust their income and custodial.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. The American Rescue Plan expanded the credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those ages 6 to 17. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at.

You can still access the child tax credit which for the 2021 tax year is worth up to 3600 per kid under 6 and 3000 per kid between 6 and 17. IRS Updates 2021 Child Tax Credit Frequently Asked Questions Learn. For those who claimed early the IRS has.

In July parents of children. The 2021 CTC is different than before in 6 key ways. November 12 2021 926 AM CBS San Francisco.

New child tax credit payments are going out. 91 of Low-Income Families Are Using the Child Tax Credit for Basic Necessities. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

The first phaseout can reduce the Child Tax. In previous years 17-year-olds werent. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day.

The money from the overpayments is. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as. Increases the tax credit amount.

The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in.

If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the November 15 deadline you can still claim the full credit of up to 3600 per child by filing. Low-income families who are not getting payments and have not filed a tax return can still get one but they. When a married couple filing jointly owes a federal debt the IRS may seize their tax refund in order to offset the money that they owe.

It also lets recipients unenroll from advance payments in favor of a one-time credit when filing their 2021 taxes.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Delayed How To Track Your November Payment Marca

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit Delayed How To Track Your November Payment Marca

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Dates As Irs Set To Send Out New Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Missing A Child Tax Credit Payment Here S How To Track It Cnet

What Families Need To Know About The Ctc In 2022 Clasp

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit 2022 175 Direct Payments Could Be Sent To Millions Of Americans In Some States See If You Qualify

2021 Child Tax Credit Steps To Take To Receive Or Manage

October Child Tax Credits Issued Irs Gives Update On Payment Delays